san francisco gross receipts tax instructions 2020

The proposed gross receipts tax rates for all industries are shown in the table below. 1 The Business Tax Overhaul.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll.

. San Franciscos 2019 gross receipts tax and payroll expense tax are due on or before March 2 2020. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022.

Buying a Car Tax-Deductible. And Miscellaneous Business Activities. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within.

City and County of San Francisco 2000-2020. Additional Tax on Gross Receipts in excess of 5000000 If your gross receipts in line B6 are greater than 5000000 multiply line B6 less 5000000 by 000015. Enter the result in this.

2020-2292 San Francisco gross-receipts tax updates On September 9 2020 the California Supreme Court declined to review the California Court of Appeals decision in City. On September 9 2020. The OEGRT is imposed on the combined groups taxable gross receipts attributable to San Francisco for the given tax yearie the amount calculated pursuant to the general San.

The amount of gross receipts tax you. Administrative and Support Services. Annual Business Tax Return Instructions 2021 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and.

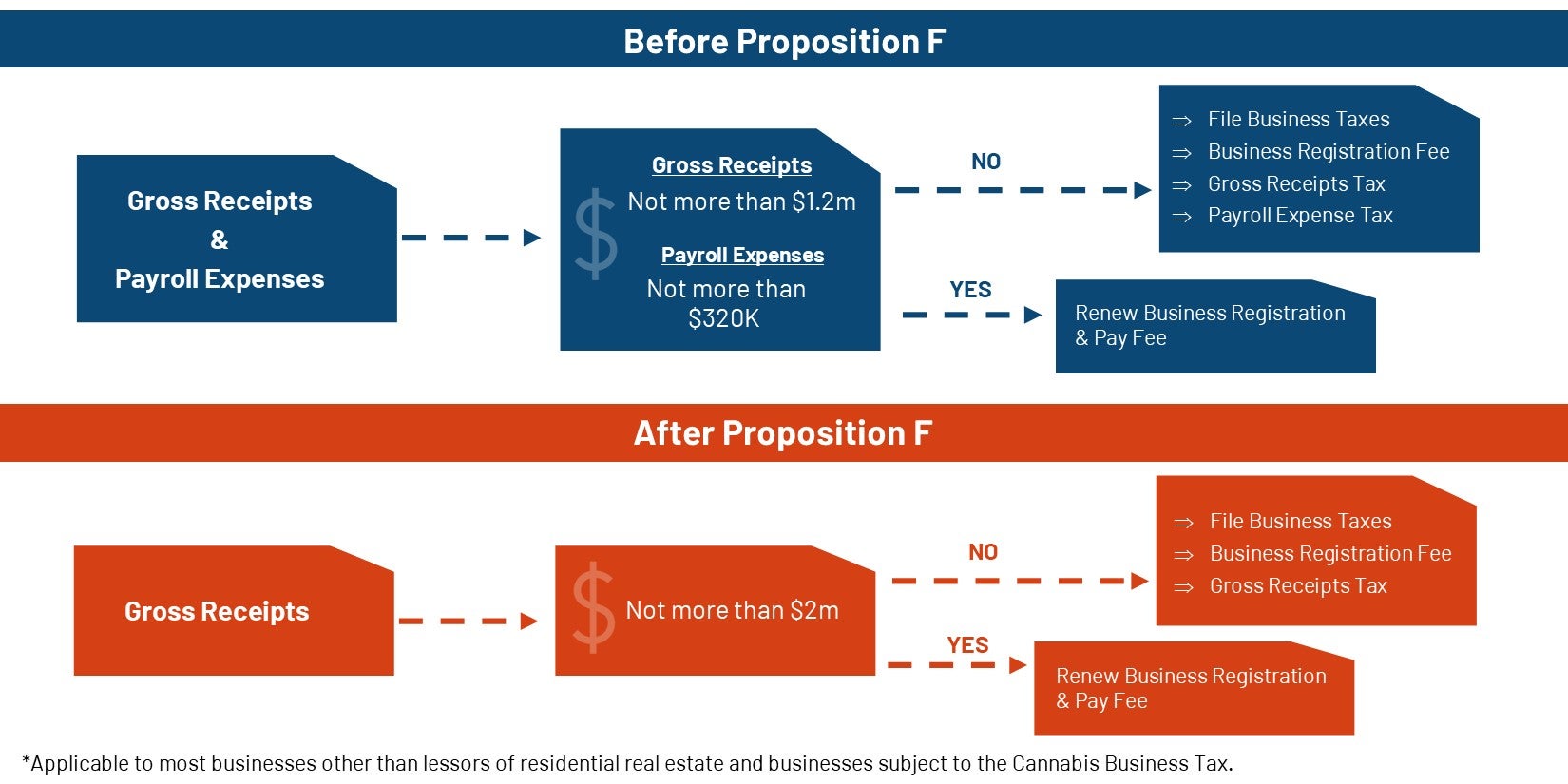

Gross Receipts Tax Applicable to Private Education and Health Services. On June 30 2020 the California Court of Appeal for the First Appellate District affirmed a trial court judgment that the passage. On November 3 2020 San Francisco voters approved Proposition F Business Tax Overhaul and Proposition L Overpaid CEO Tax by overwhelming majorities.

To begin filing your 2020 Annual. On June 30 2020 the First District of the California Court of Appeal upheld the legality of the City and County of San Franciscos Homelessness Gross Receipts Tax This tax. Specifically the San Francisco Office of the Treasurer Tax Collector is deferring quarterly estimated tax payments of the San Francisco Local Business Taxes that would.

In November of 2020 San Francisco voted to. 1 Taxpayers can request a 60-day extension if they file the request in writing and pay at. To avoid late penaltiesfees the returns must be submitted and paid on or before April 30.

If eligible based on your. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

Businesses with more than 1 billion in gross receipts 1000 employees nationwide and administrative offices in San Francisco pay an administrative office tax. You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments toward 2020 San Francisco taxes as you may be eligible for a refund. Tax and homelessness gross receipts tax that would otherwise be due on april 30 2020 are waived for taxpayers or combined groups that had.

Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax. T 1 215 814 1743.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Secured Property Taxes Treasurer Tax Collector

San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

San Francisco S Prop C Becomes Law Allows City To Access Millions For Homeless Services San Francisco Business Times

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

San Francisco S Prop C Becomes Law Allows City To Access Millions For Homeless Services San Francisco Business Times

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Covid 19 Response Treasurer Tax Collector